When applying for a Schengen visa, it is mandatory to have travel insurance covering your entire trip duration, this protects both the Schengen countries as well as the visa applicant from any expensive hospital bills.

This requirement is so important that if you do not have valid and approved Schengen travel insurance for your trip, your visa can be outright rejected.

But which Insurance is considered valid and approved? Are there any specific Insurance requirements for Schengen visa ?

This article will explain that for you and give you a list of Approved travel insurance providers for your country so that you can get your travel insurance for a Schengen visa from the right source.

Is it mandatory to get a travel Insurance for Schengen visa ?

Yes. According to It is mandatory to provide a proof of insurance when applying for Schengen visa.

When travelling to the Netherlands on a Schengen visa, you must be able to show proof that your insurance is valid for the entire duration of your stay in the Schengen area.

If you have a multiple-entry visa and it is not your first trip to the Schengen area on this visa, you must be able to show proof of insurance for every subsequent stay in the Schengen area.

It is important to book an insurance that gives you a certificate of coverage which not all insurance agents will give you.

Note if you are applying for Schengen visa from India, the above link will not work for you . A corresponding agency through which you can apply with is HDFC Ergo.

They have a specific version of Schengen travel insurance that covers the requirements for Schengen visa and is on the list of approved Travel insurance agencies in India.

Buy HDFC Ergo Insurance for Schengen visa

According to the European law for Visa Code :

- Applicants for a uniform visa for one or two entries shall prove that they are in possession of adequate and valid travel medical insurance to cover any expenses which might arise in connection with repatriation for medical reasons, urgent medical attention and/or emergency hospital treatment or death, during their stay(s) on the territory of the Member States.

- Applicants for a uniform visa for more than two entries (multiple entries) shall prove that they are in possession of adequate and valid travel medical insurance covering the period of their first intended

- In addition, such applicants shall sign the statement, set out in the application form, declaring that they are aware of the need to be in possession of travel medical insurance for subsequent stays.

- The insurance shall be valid throughout the territory of the Member States and cover the entire period of the person’s intended stay or transit. The minimum coverage shall be EUR 30 000.

- When a visa with limited territorial validity covering the territory of more than one Member State is issued, the insurance cover shall be valid at least in the Member States concerned.

- Applicants shall, in principle, take out insurance in their country of residence. Where this is not possible, they shall seek to obtain insurance in any other country.

- When another person takes out insurance in the name of the applicant, the conditions set out in paragraph 3 shall apply.

- When assessing whether the insurance cover is adequate, consulates shall ascertain whether claims against the insurance company would be recoverable in a Member State.

- The insurance requirement may be considered to have been met where it is established that an adequate level of insurance may be presumed in the light of the applicant’s professional situation. The exemption from presenting proof of travel medical insurance may concern particular professional groups, such as seafarers, who are already covered by travel medical insurance as a result of their professional activities.

- Holders of diplomatic passports shall be exempt from the requirement to hold travel medical insurance.

Who need a Schengen travel insurance ?

If you are one of the citizens of a country that needs a Schengen visa & you are applying for Schengen visa which is of a short stay type, then you need to get a Schengen travel insurance. The visa type can be tourist, business or visitor types.

If you are an Indian passport holder, then you can Buy HDFC Ergo Insurance for Schengen visa

So if you are a citizen of any of the below countries then you need to get a Schengen travel insurance.

| Afghanistan | Gabon | Oman |

| Algeria | Gambia | Pakistan |

| Angola | Ghana | Papua New Guinea |

| Armenia | Guinea | Palestinian Authority |

| Azerbaijan | Guinea-Bissau | Philippines |

| Bahrain | Guyana | Qatar |

| Bangladesh | Haiti | Russia |

| Belarus | India | Rwanda |

| Belize | Indonesia | Sao Tome And Principe |

| Benin | Iran | Saudi Arabia |

| Bhutan | Iraq | Senegal |

| Bolivia | Jamaica | Sierra Leone |

| Botswana | Jordan | Somalia |

| Burkina Faso | Kazakhstan | South Africa |

| Burma/Myanmar | Kenya | South Sudan |

| Burundi | Kosovo | Sri Lanka |

| Cambodia | Kuwait | Sudan |

| Cameroon | Kyrgyzstan | Suriname |

| Cape Verde | Laos | Swaziland |

| Central African Republic | Lebanon | Syria |

| Chad | Lesotho | Tajikistan |

| China | Liberia | Tanzania |

| Comoros | Libya | Thailand |

| Congo | Madagascar | Timor-Leste |

| Cote D’ivoire | Malawi | Togo |

| Cuba | Maldives | Tonga |

| Dem. Rep. Of Congo | Mali | Tunisia |

| Djibouti | Mauritania | Turkey |

| Dominican Republic | Mongolia | Turkmenistan |

| Ecuador | Morocco | Uganda |

| Egypt | Mozambique | Uzbekistan |

| Equatorial Guinea | Namibia | Vietnam |

| Eritrea | Nepal | Yemen |

| Ethiopia | Niger | Zambia |

| Fiji | Nigeria | Zimbabwe |

| North Korea | Northern Mariana’s |

What are the requirements for Schengen travel insurance ?

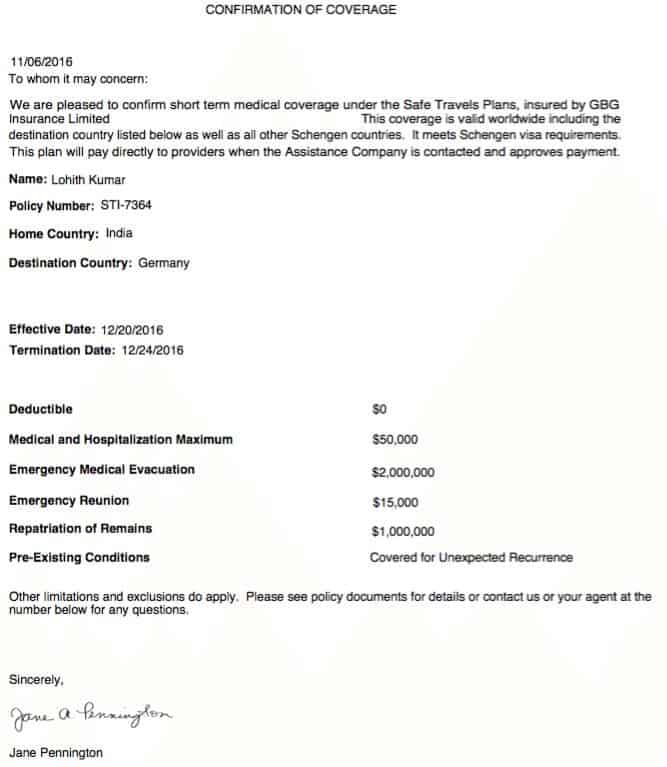

When you apply for a Schengen visa you must show proof of insurance, such as the first page of your insurance policy (policy schedule). The document must show that:

- you are covered by the policy

- the insurance provides cover in all the countries of the Schengen area for the entire duration of your stay

- the insurance covers at least €30,000 in medical expenses for:

- hospital admission and treatment

- emergency treatment

- prescription medicine

- repatriation to your country of residence (including in the event of death).

You will also get a confirmation of insurance coverage document which must be submitted along with other visa documents

Which Insurance to buy for Schengen Visa ?

This is a tough question as the requirement for Schengen visa insurance is dependent on your citizenship. Generally, A list of approved Insurance vendors are published by the consulate.

Approved Schengen insurance providers in India

Apollo Munich Health Insurance Company 6 months – 70 years

Bajaj Allianz General Insurance Company 6 months – 70 years Travel Prime Super Age Policy without age limit

Bharti AXA General Insurance Company 3 month – 85 years

Cholamandalam MS General Insurance Company 0 month – 70 years

Cigna TTK Health Insurance Limited 0 month – 75 years

Go Digit General Insurance Limited 0 month – 99 years

Future Generali India Insurance Company 6 months – 70 years

HDFC ERGO General Insurance Company 3 months – 70 years

ICICI Lombard General Insurance Company 3 months – 50 years Policies for Schengen Countries 51-85 years

IFFCO – Tokio General Insurance Company 3 months – 70 years

National Insurance Company 6 months – 60 years Schengen Plan 61- 80 years

Reliance General Insurance Company 3 months – 70 years Travel Care Policy – Schengen Plan up to 71-80years

Religare Health Insurance Company All Plans without age limit

Royal Sundaram Alliance Insurance Company 3 months – 70 years

SBI General Insurance Company 6 months – 70 years

Shiram General Insurance Company 3 Month – 65 years

Star Health & Allied Insurance Company 6 months – 70 years

Tata AIG General Insurance Company

6 months – 55 years

Travel Guard (without Sublimits) 56-70 years

Travel Guard Senior (without Sublimits) 71years and above

The New India Assurance Company 6 months – 70 years

United India Insurance Company without age limit

Universal Sompo General Insurance Company 0 month – 95 years

Accepted Travel insurance for Schengen visa – Phillipines

Malayan Insurance Company, Inc.

∙ Website : https://www.malayan.com/

- Assist-Card

∙ Website : https://www.assistcard.com/ph - Standard Insurance Co

∙ Website : https://www.standard-insurance.com/index.html - Starr International Insurance Philippines

∙ Website: https://starrcompanies.com/ - Pioneer Insurance and Surety Company

∙ Website: https://www.pioneer.com.ph/ - MPioneer

∙ Website: https://mpioneer.com.ph/ - Pacific Cross Insurance, Inc.

∙ Website: https://www.pacificcross.com.ph/ - MAPFRE Insular Insurance Corporation

∙ Website: https://www.mapfre.com.ph/ - Liberty Insurance

∙ Website: https://www.libertyinsurance.com.ph/ - Mercantile Insurance Company

∙ Website: https://mercantile.ph/ - Cocogen Insurance

∙ Website: https://www.cocogen.com/ - PGA Sompo Insurance Corporation

∙ Website: https://www.pgasompo.com.ph/personal - Philippine British Assurance Company

∙ Website: http://www.philbritish.com/ - MAA General Assurance Phils., Inc. (premium coverage plan only)

∙ Website: https://maa.com.ph/ - Paramount Life & General Insurance

∙ Website: https://www.paramount.com.ph/ - AXA Philippines

∙ Website: https://www.axa.com.ph/ - Fortune General Insurance Corp.

∙ Website: https://fgeninsurance.com/ - FPG Insurance

∙ Website: https://www.fpgins.com/ - ETIQA

∙ Website: https://www.etiqa.com.ph/

Accepted Travel insurance for Schengen visa – Africa

Africa Merchant Assurance Company Ltd (AMACO)

Fidelity Shield Insurance Company Limited

Heritage Insurance Company Ltd

Kenindia Assurance Company Ltd

Occidental Insurance Company Ltd

Pacis Insurance Company Ltd

Sanlam General Assurance Ltd

ICEA LION General Insurance Co. Ltd

Geminia Insurance Company Ltd

Jubilee Allianz General Insurance (K) Ltd

GA Insurance Ltd

CIC general Insurance Ltd

AIG Kenya Insurance Company Ltd

Pioneer General Insurance Ltd

Tausi Assurance Company Ltd

Corporate Insurance Company Ltd

Old Mutual General Insurance Ltd

First Assurance Company Ltd

APA Insurance Ltd

What does $0 deductible insurance for Schengen visa mean ?

The deductible component in a Schengen insurance indicates the amount you have to pay out of your pocket before the insurance pays out the balance.

For example if your insurance has a deductible of $450 and your medical bill is $1000 , then you will pay $450 of the bill and the insurance $650.

When getting travel insurance for a Schengen visa, you need insurance with $0 deductible. Although some of the consulates would consider insurance which is not $0 deductible, it is best that you get one without a deductible.

What are the requirements for Schengen visa travel insurance?

- €30,000 insurance cover (Our suggested insurance provides € 45,000)

- 0 deductible insurance

- 1-page insurance letter

- Covers repatriation & evacuation charges

- Medical exigencies

- Emergency situations like evacuations

- Hijacking

- Repatriation of remains on death

- Return of a minor

- Trip cancellation, rescheduling or interruptions

- Accidental death, injury or disablement and dismemberment

- Overseas outpatient, hospitalizations, medicine, death and funeral expenses

- Lost/damaged stolen baggage, travel documents or personal effects

- Delayed baggage or replacement for emergencies

- Travel delays due to inclement weather

- Even pregnancy cover is possible during the first trimester but after that each policy terms will vary. Check specifics for each policy before you make a choice.

Can I cancel my insurance if my trip gets cancelled?

Yes !! you can drop an email to track international and get the whole insurance cost refunded to you. But please note that you can cancel insurance before the policy becomes active.Yes !! If your trip is cancelled, send an email to track and you will get your insurance cost refunded to you.

What does a travel insurance not cover ?

Most plans for Schengen visas will have their own list of things they don’t cover, which is hard for insurers to cover –

- Diabetes, heart problems, and high blood pressure that were there before are usually not covered. Even sudden recurrence of a pre-existing condition that had been fixed but came back without notice and was confirmed by a doctor is often not covered. If you have a pre-existing condition like this, make sure it’s covered by paying a higher premium or getting an add-on insurance.

- You won’t be covered for flying, scuba diving, and other risky adventure sports unless you buy an add-on.

- Travel insurance also doesn’t cover trips to dangerous places like war-torn countries, countries with a lot of natural disasters, or countries where terrorist attacks happen.